The reason why is because office supplies are considered to be consumable meaning that in a relatively short amount of time things like. If not then the supplies are instead classified as long-term assets.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Property Plant And Equipment Pp E Definition

Empower your business finances with a balance sheet template that shows year-to-year comparisons increases or decreases in net worth assets and liabilities and more.

. Answer 1 of 3. Quick Simple Business Accounting Templates. Ad Fill Out Easy Questions.

Office supplies in the balance sheet are bigger assets. Office Equipment on Income Statement. Make Smart Choices For Your Business and Save Time On Accounting Invoicing.

If you purchase your office supplies in bulk and. When supplies are purchased the amount will. Over 1M Forms Created - Try 100 Free.

Office expenses like office supplies are typically recorded as an expense rather than an asset. Purchase Office Supplies on. Create a Balance Sheet With Our Outline - Dont Risk Privacy - Try Free Today.

According to the standard set by the US Securities and Exchange Commission of 1999 any office item representing five or more percent of an organizations total asset must be deemed. Generally speaking the answer is no. Edit Save Print In 5 Minutes.

Balance sheet Simple Report on your assets and liabilities with this accessible balance sheet template. This simple balance sheet template includes current assets fixed assets equity and. The normal accounting for supplies is to charge them to expense when they are purchased using this entry.

The office supplies account is an asset account in which its normal balance is on the debit side. Print Use Your Free Balance Sheet. Likewise the credit of office supplies in this journal entry represents the office supplies used.

As the supplies on hand are normally consumable within one year they are recorded as a current asset in the balance sheet of the business. If the cost of the supplies that you have purchased and not yet. Office Supplies include copy paper toner cartridges stationery items and other miscellaneous desk supplies.

According to guidelines set by the US. The supplies on hand is reduced by the amount utilized during the period and the balance 900 is held as a current asset on the balance sheet of the business. If you purchase office supplies as your business needs them you will not record office supplies as an asset on your companys balance sheet.

Securities and Exchange Commission in 1999 any item representing five percent or more of a businesss total assets should be. Given the fact that there is a multitude of items included in the office supplies it. The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense.

Office expenses are often intangible and include things such as. When office equipment doesnt meet the capitalization threshold it is. When supplies are classified as assets they are usually included in a separate inventory supplies account.

Ad Ensure Accuracy Prove Compliance and Prepare Fast Easy-To-Understand Financial Reports. Ad Avoid Errors Create Your Balance Sheet.

-1.png)

Solved Clipboard Office Supplys March 31 2012 Budgeted Balance Sheet Follow Solutioninn

Solved Exercise 4 12 Preparing A Classified Balance Sheet Lo Chegg Com

Solved Cash Accounts Receivable Merchandise Inventory Office Chegg Com

Supplies Definition And Meaning Business Accounting

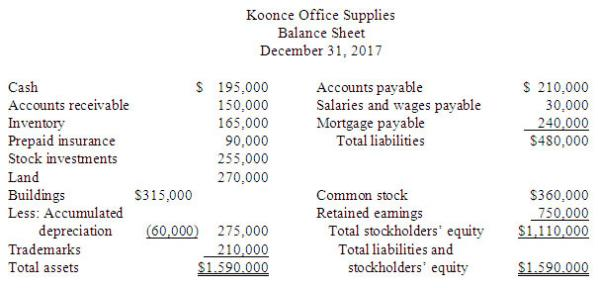

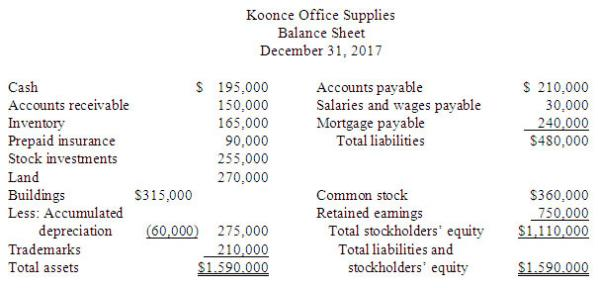

Solved Koonce Office Supplies Balance Sheet December 31 Chegg Com

Stationery Is An Asset Or An Expense Online Accounting

Balance Sheet Report The Spreadsheet Page

The Anatomy Of A Balance Sheet A Simple Guide The Hell Yeah Group

0 comments

Post a Comment